Day trading in cryptocurrencies such as bitcoin, ether and bitcoin cash is a great way to work for yourself and make money. Cryptocoin Day trading is a new thing, it has gotten popular in 2017 and it is very accessible. It does not cost much to do, in fact there are even day trading platforms that you can access for free.

How to day trade cryptocurrency? To begin with, all that you need is some coins and you can start trading already. It is a great way to make money since these bitcoins and all other crypto currencies such as most altcoins show a great growth curve. However, it does take knowledge and good skills to actually earn money. Good news is that you can learn those skills with this Day Trading Cryptocurrency Beginners guide.

Day trading Bitcoin and other cryptocurrency

If you want to considering day trading, then Cryptos such as bitcoin are a great way to start day trading because:

- Bitcoin is easy to start doing day trading. It is low cost and you don't have to pay anyone or be a member of a platform which is the case with Futures and Forex for example. Besides, day trading in stocks is often not allowed when you do not bring in enough money.

- You don't need much to start with. You can even start for free if you can get free bitcoins, or (easier) free altcoins or you can also borrow bitcoins online.

Bitcoin Day Trading Tips:

- Getting some free coins to play with is the easiest way to start. On Free Coins subreddit and Bitcointalk you can find people giving away coins they want to pump. The amounts are often tiny but it's free play money.

- You can also buy Bitcoins or other coins such as Ethereum (the latter is a lot easier and faster to transfer), Dash or Monero. You can buy them with your creditcard or bank transfer at Coinbase.com for example, or any other service really. After you bought the coins you can transfer them to your exchange service.

- A good way of starting to start day trading alt coins is putting in as little as 50 dollar or 100 dollars. If that is money you could easily miss that is. Regard this money as playmoney - you can even make conscious mistakes so you can learn. But it is essential to actually play with money so that you get the real feeling, to really feel your stupidity and adrenaline shots; these are emotions you got to know how to deal with anyhow.

Bitcoin day trading strategies

There are many Cryptocoin or Bitcoin day trading strategies. Most people actually do not do day trading but just let their money sit, which is great because as long as the coins are going up, your investment goes up in value. However this is day trading we are talking about, being active on the currency exchange. If done well you can even make a lot more than just by letting your money sit and wait. You do need to know what you're doing though, otherwise you just end up losing it all.

So let's explain a simple beginners strategy. This strategy makes you learn by trial and error. We are gonna make relative easy wins by using a strategy called trend following. If you do well you make some money on the way. Check for a moment in your favorite altcoin market where there has been a lot of overselling. You can recognize overselling by checking the volumes in bars below the main graph (if it's not there you gotta enable it first). After overselling there is often a big bump up. You buy into that bump when the price is the lowest. Then you wait until the price goes up again and you sell when you see the price goes down again.

This is a very simple strategy that makes you make small wins. It will get you acquainted to how the system works. You can ride the waves so to say. First you can take some small ones, later you can take the longer ones. When you follow this pattern 20 times a day, you win some and you lose some. Because obviously things also go down as you make wrong judgments. This is not bad in itself. But it feels pretty shitty if your money is in it. There are two things you can do here: let it go and check again later. You often notice it has gone up again. Or you just sell immediately. Remember you are learning and you can see benefits give each of these strategies.

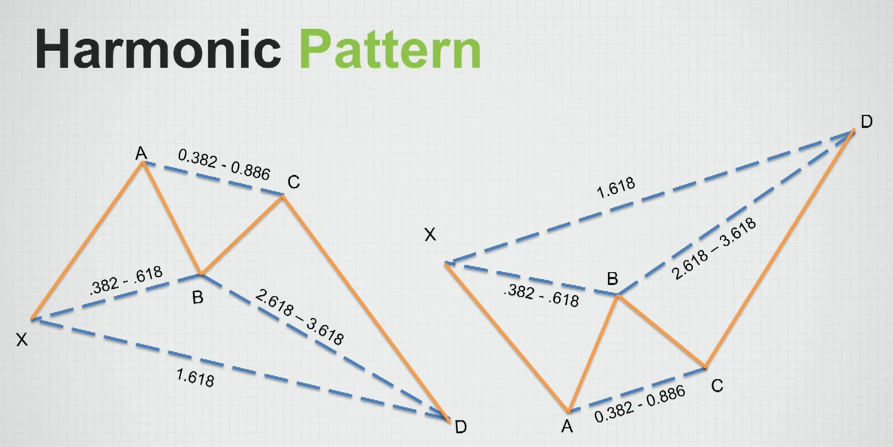

This type of trend following is also referred to as Reversal trading. As soon as you came to understand this simple strategy you can move on and learn more about patterns. Day trading is all about odds calculation. And you increase your knowledge about those odds by learning how to interpret patterns. Therefore it is essential to learn how to read stock charts. Like this you can be aware of when prices are more likely to move up or down. If you want to get serious about day trading, research these patterns well.

Get to know your markets

It is vital to understand what are high prices and low prices. You do not have to know much about the underlying technology such as blockchain and what cryptocoins do or can do. But what you do want to know is what constitute a high price, and what is a low price. It is therefore smart to just follow one market for a couple of days or even a week and just play around a bit with your playmoney. Seize your moments and see where it is going. Be happy with little wins and don't cry about your losses. You are learning.

Pump and dump

A lot of the ICOs and coins out there are simply pump and dump schemes. Always be wary of anything you hear or read. When small unknown coins are going up quickly (the pump) there's a good chance they will come down even harder (the dump). If you are aware of this you can actually make money, but it's risky of course.

Day trading software

Just like these currencies exists totally online, the exchange markets do to. Trading is really just one click away. You don't need special Day trading software for bitcoin, there are many exchanges online where you can just start day trading right away.

- Cryptowatch.ch has one of the nicest interfaces and is fast. It doesn't drain your cpu and you can easily have multiple tabs open. It is an open platform, you can use any of the other trade platform here below and use their API to connect with Cryptowatch.ch. Using it costs 15dollar per month but it comes with a free trial of 2 weeks.

- Trade.kraken.com is the same interface and is for free. You can only use if in conjuction with Kraken though and not with the other platforms.

- Bitfinex.com is well known but its interface is not fast. It can also be a bit heavy on the cpu once you have multiple tabs open. We do not recommend its interface. Of you want to trade with Bitfinex, it works better if you use their API and trade through Cryptowatch.ch.

- Other well know platforms include GDAX, https://www.bitstamp.net and https://poloniex.com/

Mindset of a day trader

Trading is really about staying rational. There is no space for your sentiments. You better lay out a rational strategy and follow that. Often if you follow your feelings you lose. Your feelings are exactly this: sentiments often created by your emotional state in relation to the flow of the currency prices. "Fear of missing out" is something that will make you loose all of your money in a Day Exchange. This is why some people fail horribly at day trading, because they follow their emotions. Consider this quote from an experienced Bitcoin day trader.

A day trading mindset has no room for opinions. If you are slow to move, or stubborn, or don't have a clear trading plan with stops and targets predefined, then you really should not be trading this market at all.

Things to keep in mind

In the cryptomarket things are very related. If there is a lot of trade happening in one coin, often trade in another coin is low. So if you notice a lot of movement in one currency, like BTC for example. Then often you find trade in another currency like ETH relatively low. Also you can witness that if there is a lot to win in one coin, lots of money are retracted from another. Most traders have budgets and money almost always moves there where there is more to make.

You also have to keep in mind that Crypto's are being pushed at the moment. They have a lot of momentum. After traders have pushed one coin, they often move to another coin and so on. Many coins have insane growth rates like this. As soon as a coin gets stable at a certain level, traders will see that as a sign of confidence and will keep on pushing/ pumping even more. There will come days that big crashes will happen. Either you move out before the crash, or just wait and hold, most crashes will be overcome by time. Look at the historical data to get an idea of those crashes.

Understand

- There are many curves and lines and waves in play. What it comes down to is to rationally understand how markets evolve and how to interpret movements of waves.

- It is vital to have a well defined strategy: when do you move in, when do you move out. Keep yourself to this strategy. Do not change it while you are doing it, unless some really important swings are forcing you.

- It is easier to trade when curves are showing an upwards line. If you have already gone up a couple of waves you can hold longer without losing much compared to your initial investment. Be sure to have you exit strategy at hand though.

- If trade is showing a downtrend you better not stick too long. If you buy low, sell right again after the first up. Like this you avoid loosing your money if the line happens to go straight down.

- When zigzag-lines are becoming more straight, it is more likely to go down than up. This is because of uncertainty. This will not be the case when some big investor pumps it, then it is more likely to become a line up again, especially when it is followed up by more (small) pumps.

- Buying in when the line is already going up will often prove to be more risky than buying in when line has reached a bottom.

Do's

- Make in/out strategy. Make a note or draw a line where is your baseline for selling or buying. If you reached that point but line keeps on going up, hold. If it keeps on going down, sell. This strategy will reduce your risk.

- Keep notes. Know what you do and write it down. If you write down your conclusions, you will also learn better and improve more. Writing stuff down always help. It is recommended to do this even with pen and paper.

- Write down progress. make a note of how much you earn. When trading back and forth to US dollars or Euros for example, keep track of the progress. Only like this you know if you are actually earning or not.

- When playing with $100.00 or $50.00, just pretend it is $10,000 and $5,000. As such you would know what you would actually earn if that would be your money to invest.

What to avoid

- (Try not to) gamble. There are no guarantees for movements. But if you learn to see how patterns and understand how to read stock charts you can decrease the amount of gambling. If you start with moments when there has been a big sell-out for example, you buy at that moment and sell immediately after that first wave settles. Like this you get your earnings one crumble at a time while minimizing your risks.

- Don't give up. Each moment is a learning moment. Where others fail and stop, you fail, continue and develop your skills even further.

Where to get your info

- https://www.babypips.com/learn Is a great website to learn more about Forex trading. You can directly apply your new acquired knowledge and skills to cryptocointrading. Another great website about learning how to trade and read stock charts is http://beginningstocktrader.com/

- https://www.tradingview.com/symbols/BTCUSD/ gives great insights from traders and analysts. You can also look for other pages such as ETH and BCH, as well as any other currencies you'd like to follow.

- https://www.reddit.com/user/decryptedcoin/m/cryptocoins/ offers a great overview of all kind of subreddits where you can follow important news and updates. Most important news from other websites such as https://bitcoinwisdom.com/, https://coinmarketcap.com/ and https://www.coindesk.com/ are being posted here. You also find news from https://cointelegraph.com/, https://bitcoinmagazine.com and https://www.cryptocoinsnews.com but do note that a lot of posts you find there are sponsored articles.

- Twitter is also a great place to stay on top of things. See for example https://twitter.com/tuurdemeester and https://twitter.com/cburniskeas well as this official twitter blog post. Be aware that there are a lot of bots pumping and dumping coins.