Investing in P2P credit is an interesting to get a much better yield than with a classic saving account. 10% and higher are the norm rather than the exception.

If you live in a country without strict CFC rules you can take it a step further and set up a corporation in Estonia. Estonia's e-residency makes it very easy to establish and run a corporation from abroad. Literally zero paperwork. On top of that Estonia's corporate income tax is 0% as long as you keep the money in the company. Here we give some insights into actually investing through some of the P2P lending platforms.

Background

Around 2007 Lending Club started filling the gaps left by banks.

Ethics

Investing in short term "loanshark" style loans can feel wrong. The other side of this is that the more investment money flows into this, the lower the actual interest rates for borrowers will be.

Risks and disadvantages

There are several risks related to P2P investing:

- Platform goes bust. This has happened. It's preferable to invest through platforms that have been around a while, and to invest through more than one different platform.

- Borrowers default on your loans. To avoid this you usually spread your investment over many loans. It's also good to spread over loans with different risk categories. With some platforms you can go as low as 1€ per loan. With others the minimum is 100€ or more.

- Cash drag: if your money is not (re)invested quickly enough you don't get any interest.

- Currency exchange risk. If you invest through Mintos you can invest in loans in a dozen different currencies. This can of course also be turned into an advantage if you want to spread your money over various currencies (but there are fees).

P2P investment platforms we tried

Bondora

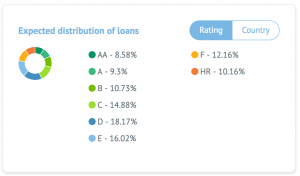

Bondora is an Estonian p2p lending platform. Investing in p2p loans through Bondora is quite easy. The downside is that Bondora does not have a buyback guarantee. The upside is that you can diversify into many loans as the minimum investment per loan is only 1€.

Mintos

Mintos is a Latvian platform, one of the biggest in Eastern Europe.

Twino

Twino is also based in Latvia. We've experienced small bugs with their auto invest feature so it's hard to recommend this platform currently.

Estateguru

Estateguru is an Estonian real estate loans platform. The downsides of Estateguru is the cash drag.

Crowdestate

Crowdestate is another Estonian real estate platform, with even less possible investments than Estateguru.

Other options

We also looked into platforms in other countries, but the encountered bureaucracy was significantly more cumbersome than with the Baltic platforms:

- Auxmoney - German, silly paper demands

- Lendix - French, only allows corporate entitities investing more than 100k€

- Fellow Finance - Finnish - in progress, requires a "board decision"

- Fixura - Finland - not looked into yet